“Like mothers, taxes are often misunderstood but seldom forgotten”

Lord Bramwell, Judicial Member of the House of Lords.

Almost every investment and investor, pay taxes. What many taxable investors don’t pay a great deal of attention to (if at all), is evaluating investment performance on an after-tax basis. In the financial advice world, where the cost of compliance and delivery of advice continues to grow, every dollar saved makes a material difference.

Tax-aware investing in its simplest form involves selling a security at a loss, which can then potentially be used to offset capital gains elsewhere. The proceeds of the sale of these securities are then re-invested to maintain the portfolio’s investment objective, e.g., index replication. This process in and of itself introduces re-investment risk, let alone how to do it without breaching the wash sale rule, amongst other legislative considerations.

Importantly, despite the explosive growth of ETFs and index-based mutual funds, none of the above is achievable in either structure: ETF investors own interests in the ETF and not the underlying shares within the fund itself.

Recently, advancements in technology have made great strides in de-mystifying and implementing tax-aware investment strategies, potentially boosting after-tax investment performance. These benefits come about for two main reasons:

Investors hold beneficial ownership in the stocks themselves and not units in a pooled trust.

Advancement in portfolio optimisation techniques and cloud-based technology, now allowing for improved tax-aware investment efficiencies for every taxable investment account, using a Direct Indexing approach.

Direct Indexing and tax-aware investing

Extensive research from the US indicates that improved tax efficiency is one of the most sighted benefits of Direct Indexing. This should come as no surprise. Any taxable investor is right to be concerned with evaluating performance on an after-tax basis. Having worked in investment management for many years, I’m confident that very few of my clients would have a clear idea what their investment performance is on an after-tax basis. The investment management industry has traditionally been focused only on pre-tax returns, when in fact, it’s after-tax returns that matter. After-tax dollars are, after all, what you spend. Notwithstanding, true personalised tax-optimisation requires three key factors:

Direct, beneficial ownership in the underlying securities.

A well-considered tax-aware investment approach.

The technological scope to employ the investment approach across not few, but many, clients.

The Australian Context

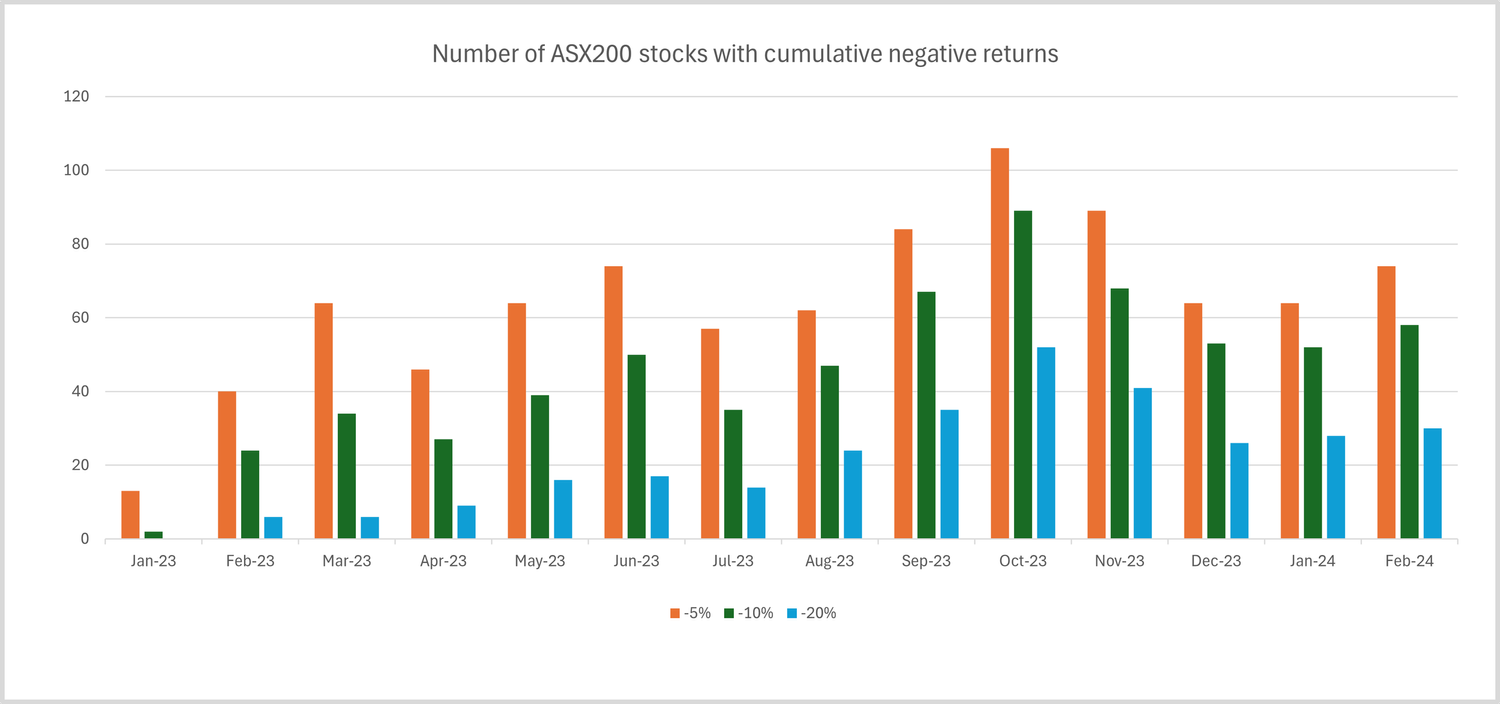

It’s not uncommon for investors to wait until the financial year end to crystallise any tax losses within their portfolio. Doing this only once a year misses out on realizing loss opportunities throughout the entire trading year. The cumulative monthly price returns of all two hundred stocks within the Australian equity index universe in 2023 shows that ample opportunities to harvest losses abounded. Despite the Australian equity market returning over 12% for the year (including dividends), there were plenty of opportunities to harvest tax losses on an individual stock basis.

Had a hypothetical investor commenced an Australian equity index replication portfolio at the start of 2023, there were many stocks that exhibited a cumulative loss in each and every month.

Holding individual securities, as opposed to holding units in an ETF or mutual fund, allows for technology to not only manage index replication in a more tax-aware fashion, but also provides the investor customisation that cannot be achieved in any pooled vehicle, be it ETF or index fund. These customisations can be values-related such as ESG, or removing industries and sectors, as well as managing concentrated stock positions. Direct indexing allows any financial advisor to tailor an investment portfolio to their clients’ own unique values and goals, all done at scale using state of the art technology.

The potential benefits of Briefcase direct indexing can be significant, but those benefits depend on multiple factors, including investors own unique tax considerations, investment time horizon, asset allocation, and preferences related to customised index-based strategies. Briefcase’s pioneering investment technology now empowers investors and their advisors to do just that.

Like to know more? Contact us at enquiries@briefcase.au