“Building a portfolio around index funds isn’t really settling for the average. It’s just refusing to believe in magic.”

Bethany McLean of Fortune

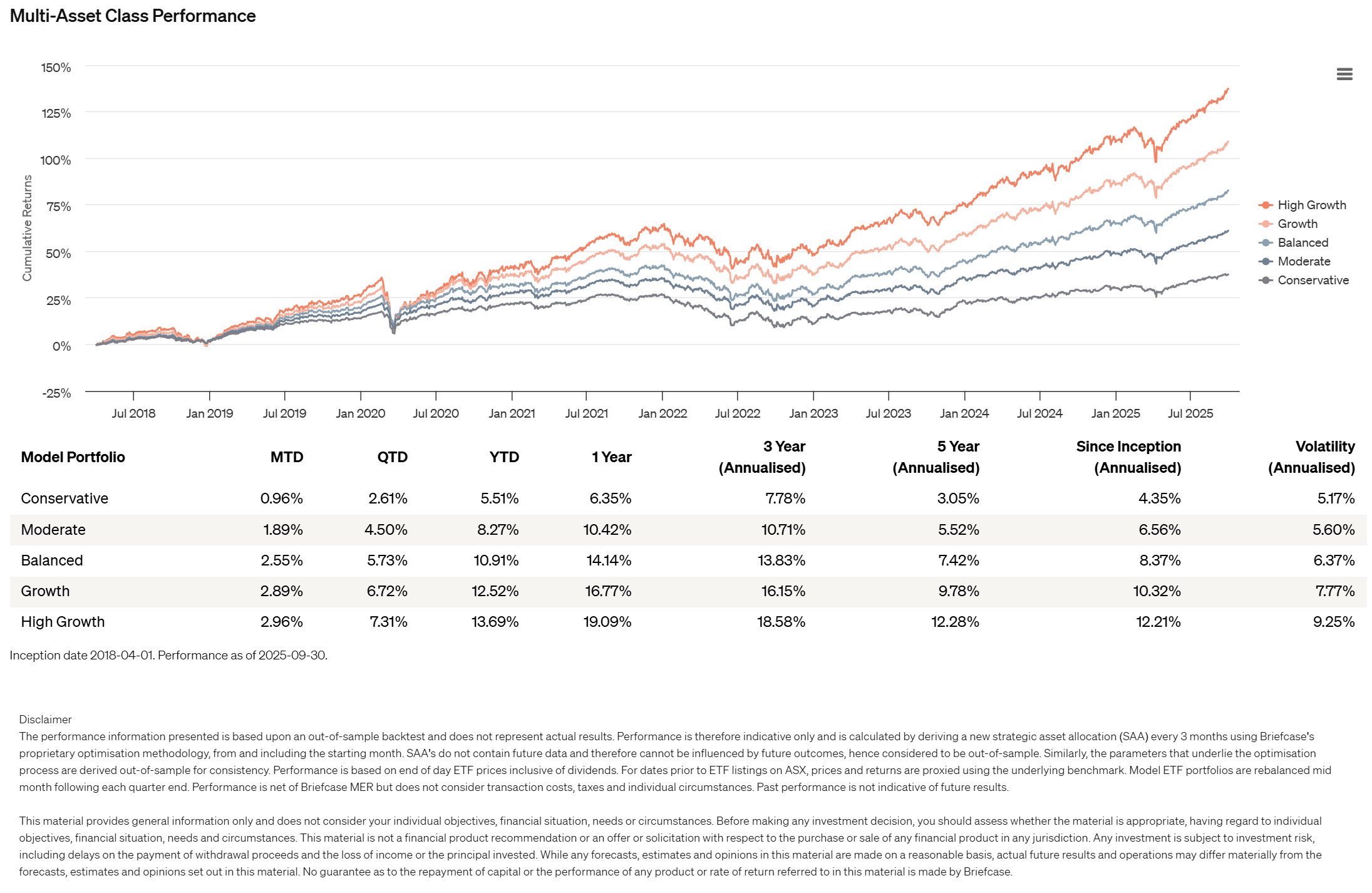

Briefcase Multi-Asset Model Portfolios

Briefcase provides a suite of diversified risk-based portfolios incorporating best-of-breed, low-cost Exchange Traded Funds (ETFs), to provide a core portfolio solution for every investor.

The benefits include:

Access to proven institutional-grade investment management expertise.

Best-of-breed ETFs selected from the full range available on the ASX.

Low-cost and optimised for net-of-fees, after-tax performance.

Access diversified, low-cost and professionally managed portfolios.

Briefcase multi-asset class model portfolios provide investors with access to proven institutional-grade investment strategies, utilising a diverse source of low-cost Exchange Traded Funds (ETFs) to achieve diversification in a strategic asset allocation framework. By optimising different return sources, such as domestic and global equities, fixed income, alternatives and cash, these portfolios aim to strike an optimal balance between risk and return.

Each model portfolio is crafted by selectively combining best-of-breed ETFs from reputable issuers, and utilising Briefcase's proprietary, rule-based optimisation technology for asset allocation to deliver superior risk-adjusted returns. This approach yields high-quality, top-tier portfolios that are cost-effective, transparent and easy to implement and manage for clients.

Five diversified risk-based models available^:

^Information current as at 30/06/2025 and subject to change.

SQM Research Report

Briefcase has been rated as favourable by SQM Research. Please get in touch if you would like a copy of the report.

The rating contained in this document is issued by SQM Research Pty Ltd ABN 93 122 592 036 AFSL 421913. SQM Research is an investment research firm that undertakes research on investment products exclusively for its wholesale clients, utilising a proprietary review and star rating system. The SQM Research star rating system is of a general nature and does not take into account the particular circumstances or needs of any specific person. The rating may be subject to change at any time. Only licensed financial advisers may use the SQM Research star rating system in determining whether an investment is appropriate to a person’s particular circumstances or needs. You should read the product disclosure statement and consult a licensed financial adviser before making an investment decision in relation to this investment product. SQM Research receives a fee from the Fund Manager for the research and rating of the managed investment scheme.

Model performance to 30 September 2025

Putting investors first - always.

Briefcase Multi-Asset Model Portfolios are designed and managed to always put investors first. We use cutting-edge technology to enable access to advanced portfolio construction capabilities at low cost and select only best-of-breed ETFs to deliver the best possible outcomes.

Cutting-edge portfolio construction and management

Formerly exclusive to institutional investors, Briefcase's proprietary technology now offers all clients the ability to leverage our advanced portfolio construction capabilities. Briefcase designs and oversees portfolios that are resilient to the intrinsic uncertainties of asset performance, ensuring the greatest probability of achieving investment objectives.

Furthermore, our proprietary, long-run strategic asset allocation framework is designed to reduce portfolio turnover and thus further reduce unnecessary costs.

Low-cost and tax-aware

High fees and portfolio turnover negatively affect investment returns over time. At Briefcase, we build portfolios using cost-effective ETFs and leverage scalable technology to keep fees low.

We also understand that it is the after-tax return in the hands of investors that really matters, so we ensure portfolios remain tax-aware at all times.

Best-of-breed ETFs

At Briefcase, investors always come first, which is why we have no affiliations with any investment managers or ETF issuers. Our discerning selection of top-quality ETFs from reputable managers ensures that only exposures that pass our rigorous screening process are included in the investible universe. These exposures are only then incorporated into a model portfolio when their inclusion is additive to the Strategic Asset Allocation (SAA).

By using only low-cost, transparent and liquid ETFs, Briefcase Model Portfolios provide investors with the highest probability of meeting their investment objectives.

Experience that matters

We believe investors deserve more than just a return on their investment – the Briefcase team’s collective experience in managing more than $50bn and formidable track record means that investors can expect peace of mind, strategic foresight, and the ability to navigate through any economic climate.

A core investment proposition for advice practices.

If you are seeking a core portfolio solution that provides:

Quality and efficiency, without the high cost.

Cutting-edge technology and leading adviser support.

Choice of implementation via wholesale or retail managed accounts with leading investment platforms.

Contact us at enquiries@briefcase.au or click the button below.